Reality Check for Homebuyers – Higher Mortgage Rates Here to Stay

Homebuyers shouldn’t postpone ownership thinking that today’s rates are temporary!

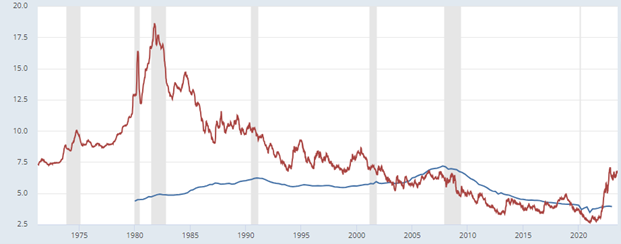

The era of low mortgage rates is over. .Accepting this reality will move you closer to owning a house that meets your needs.Low rates flourished for 11 years, as the 30-year mortgage remained below 5% from February 2011 to April 2022. Since then, it has remained mostly above 5%, averaging 6.72% in June and hitting a high of 6.81% today.

Inflation is the problem

Economists monitor tons of data when forecasting mortgage rates. But if you ask them what regular folks should keep an eye on, they reply as one: inflation.

Though inflation is not directly linked with mortgage rates, an easing of inflation will help bring mortgage rates down for two reasons:

First – lower rates of inflation will dampen the Fed’s enthusiasm for rate increases.

Second – lenders will “stop adding an inflation premium to their mortgage rate. (They do that to account for the fact that future dollars that are used to pay back the mortgage aren’t as valuable).

Some forecasters predict that rates will decline over the next 12 months. But even they don’t foresee rates dropping below 5% anytime soon.

So, if you want to buy a home, waiting for interest rates to drop significantly is not a winning strategy and won’t get you closer to the purchase of the home of your dreams.

Home buyers need to reach the stage of acceptance at some point that rates aren’t going to come down to 2.99%where we were back during 2020 and 2021.

Forecasters predict a modest decline in rates

It’s not all gloom and doom. Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors all forecast a gradual, moderate decline in mortgage rates through at least the first three months of 2024.

Those three organizations are not alone in their prediction that mortgage rates will go down, but no one expects rates to plunge back to where they were two years ago.

Most experts expect that rates will be at or near 6% by the first quarter of 2024.

One takeaway from these forecasts: if you hold out for dramatically lower rates, you’ll probably be waiting for Godot. Keep in mind that you can marry the house but rent for an initial interest rate. If rates do fall substantially after you buy, you can refinance.

BUt as long as inflation stays spitefully high, mortgage rates will remain elevated.

3% Mortgage Rates are not coming back.

Let’s say the Fed eventually succeeds in taming inflation to 2%. That will be worth celebrating, but it doesn’t necessarily mean mortgage rates will wander south of 5%.

The Mortgage Bankers Association forecasts the 30-year mortgage will dip below 5% toward the end of 2024, but Fannie Mae and the Realtors don’t predict rates will fall t even that far.

So as much as we might not like to admit it, it is not realistic to put a home purchase on hold in the hope that mortgage rates will return to 2020 and 2021, they won’t. Maintaining that hope will just cause you to miss out on the home of your dreams.

NOTE: The median mortgage rate over the past 30 years is 5.77%. In effect, rates really have just normalized back to their historical median value! Many mortgage companies offer buy-downs that will get you to that rate now.

I am hopeful that this article will make you more knowledgeable about and accepting of the current reality of mortgage rates. Whether you’re looking for a bigger place or a smaller home, or one better located for schools or your commute in the Port St Lucie, Martin, or Palm Beach counties, give me a call or text. I am committed to providing you with superior service for all your real estate transaction needs

Tom Vehec

Providing superior service for all your Real Estate transactions

Keller Williams Realty of Port St Lucie

412-773-1056

www.tvehechomes.com